The Bottleneck Isn't Chips, It's Sparks

Australia's data centre boom has a labour problem. $56 billion in capital is committed—but who builds it?

This work was referenced in the Australian Financial Review on January 9, 2026.

$56 Billion in 24 Months

The money moved fast. Construction timelines don’t.

Four deals. Four hyperscalers. More capital committed to data centres today than total NBN costs—Australia’s largest infrastructure project.

- Blackstone acquired AirTrunk for $24B

- AWS announced $20B in infrastructure

- NextDC signed a $7B hyperscale MoU with OpenAI

- Microsoft committed $5B to expand

That’s $56B in announced DC investment since October 2023. The capital is here. The question is who builds it.

The Western Sydney Corridor

Seven projects. One labour market.

Data centre investment is happening across Australia, but a significant share is clustered in a single corridor: Western Sydney, 20-40km from the CBD.

- AirTrunk alone has 1.3 GW across two sites

- Add CDC, NextDC, Microsoft, Goodman—seven projects totalling 3 GW of planned capacity

- All drawing from the same local workforce

When every project needs the same electricians, plumbers, and HVAC techs, geography becomes a constraint.

Who Builds This?

National apprenticeship commencements, 2022 vs Q1 2025

Every megawatt of data centre capacity needs electricians for HV switching, plumbers for cooling loops, HVAC techs for thermal management.

- Electrical apprenticeship commencements are down 13% from the 2022 peak

- Plumbers down 17%

- The 2022 baseline isn’t cherry-picked—it’s post-COVID normalisation after the Boosting Apprenticeship Commencements subsidy ended

The capital arrived. The pipeline to build it didn’t.

Who Gets the Sparkies?

Western Sydney Corridor, 2027 peak demand

The airport opens late 2026. The metro opens early 2027. Data centres are already under construction. All drawing from the same pool of 6,000 electricians.

- At peak concurrent demand, data centres alone need 2,300 electricians—half the available project workforce

- Add transport, healthcare, and housing, and demand exceeds supply by 1,170

- That gap doesn’t land on the best-capitalised projects—it lands on housing, schools, and hospitals

Deflation Creates Inflation

How cheaper AI drives higher trade wages

LLM token costs fell 99%. Demand rose 800×. That’s Jevons Paradox: when something gets cheaper, we use more of it. Every efficiency gain drives more compute, more data centres, more construction.

But electricians can’t be automated. That’s Baumol’s Cost Disease: productivity gains in one sector drive up wages in sectors that can’t follow. Software engineers got AI copilots. Sparkies didn’t.

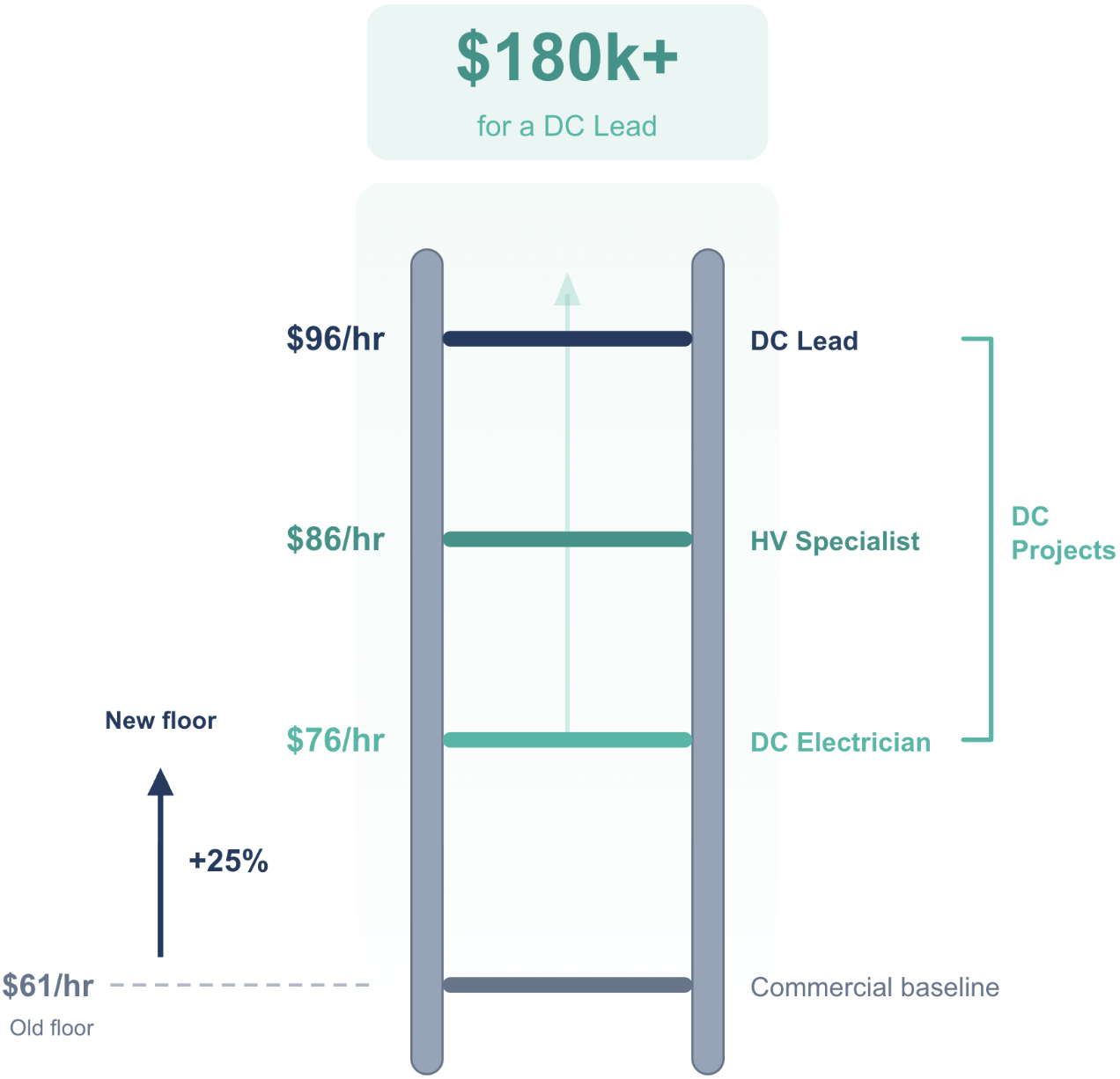

- Commercial electricians earn $61/hr

- DC projects pay $76-96/hr

- Premiums of 25-57%+

When the Ceiling Rises

So does the floor.

A Data Centre Lead earns $96/hr—over $180k+ a year. In a labour market short of electricians, workers respond to incentives. They climb toward the money.

- This pulls the entire wage structure upward

- To compete, the commercial baseline shifts from $61/hr to $76/hr

- That’s a 25% premium just to stay in the game

Everyone pays more. Projects that can’t absorb the new floor don’t get delayed—they get cancelled.

Long AI, Short Copper

The bottleneck isn’t chips, it’s sparks.

$56B in capital is committed to Australian data centres. Site selection, power access, water, government approvals, equipment—these get the attention. Labour supply doesn’t.

AI can help to design the data centre. It can optimise the power draw, model the cooling load, automate the provisioning. What it can’t do is wire it. A four-year apprenticeship is a four-year apprenticeship.

This is just the electricians. The same dynamics play out across HVAC, pipefitting, high-voltage—every critical trade that AI-era infrastructure depends on.

The shovels are ready. The question is whether the hands exist.